By Dr. Kelley Cullen

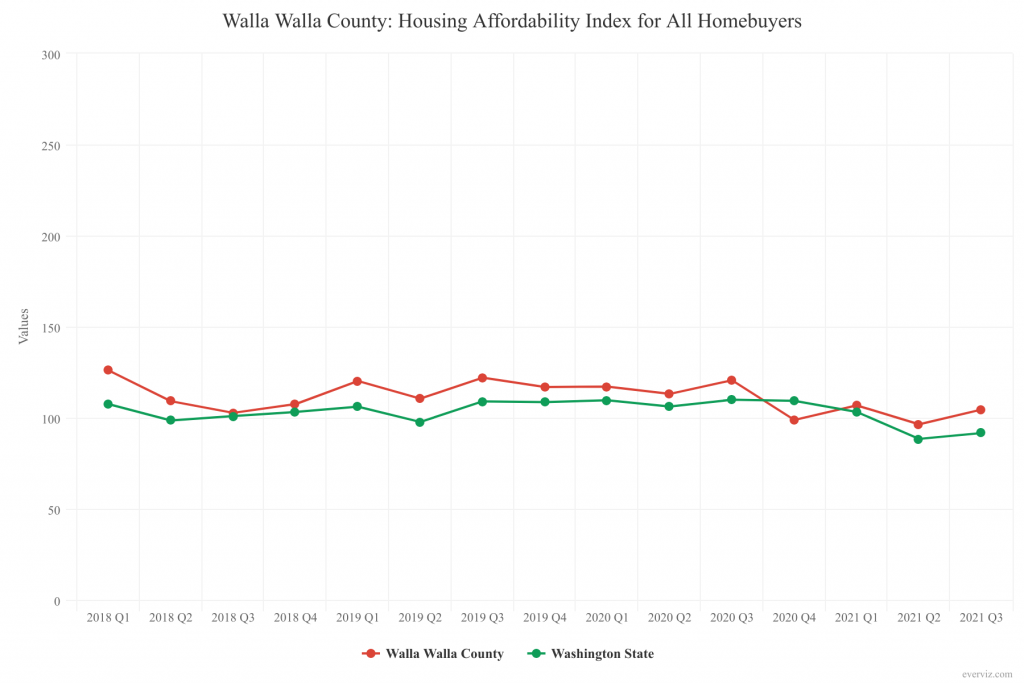

A community’s ability to attract and maintain workers in order to foster economic growth can depend upon the affordability of local housing. Although housing is still more affordable in Walla Walla County than the state average, it has become less affordable since the start of the pandemic.

The data for Walla Walla Trends Indicator 5.1.2 Housing Affordability Index (HAI) for all Homebuyers is calculated and maintained by the Washington Center for Real Estate Research (WCRER) and measures the ability of a middle-income family to make mortgage payments on a median-priced resale home. More specifically, it assumes a median-priced home, 20% down-payment, a 30-year fixed mortgage, and middle income for the area.

A central assumption of the Index is that the household does not spend more than 25% of its income on principal and interest payments. When the index lies at 100, the household pays exactly this share of its income to principal and interest. When the index lies above 100 it pays less, and when it is below 100, the household pays more. For example, if the index in an area is 154.2, the household has 154.2% of the income required to make payments on a median-priced resale home.

The good news is that after a short drop in affordability at the end of 2020, housing has become increasingly more affordable and is above the baseline value of 100 once again. At the end of Q3, 2021, an index value of 104.5 suggests that households, on average, are paying less than 25% of their income on principal and interest for a mortgage loan. Alternatively, the average homebuyer has approximately 104.5% of the income required to make payments on a median-priced home.

Historically, Walla Walla County has enjoyed housing typically more affordable than the state. In fact, as recently as mid-2020 the HAI was 120. In contrast, although the last four quarters (Q3 of 2020 to Q3 of 2021) have averaged 100.7, the index has shown slightly more volatility in ranging from 96 to 106 over the course of the year. Across the state, the HAI is 96.1 as of Q3 2021.

Although neighboring counties of Benton (124.3) and Franklin (114.10) enjoy relatively more affordable housing, they have also seen a decrease in affordability in the current year.

One of the reasons why the county might be seeing decreasing affordability is the uptick in housing prices. Walla Walla Trends indicator 5.1.1 Median Home Resale Value tracks quarterly changes in home resales. In the past year, median home resale prices have increased over $80,000 (27%) from $301,600 to $381,700. Although we do not yet have the 2021 personal income values, for reference, incomes rose 9% from 2019 to 2020, well below the rate at which the median home resale price rose. This would explain some of the drop in the HAI for all homebuyers.

The housing market was also hit by the onset of the pandemic which sent many people into lockdown in their current homes and initially, at least, slowed construction of new houses. As many people moved to working remotely, they chose to renovate existing homes, adding home offices and work spaces and making them less likely to sell. All of this further reduced supply and drove up prices.

With the current robust economy and corresponding inflationary pressures, interest rates are likely to start inching upward putting more pressure on mortgage payments and making housing less affordable than recent years. Nonetheless, Walla Walla should continue to be more affordable than the state average.