By Dr. Kelley Cullen

Access to affordable housing can be a boon to a local economy in its ability to attract and keep workers. To the contrary, higher housing prices can deter families from wanting to settle down in a local community. Although lately much of the state, and even the nation as a whole, has been experiencing steady increases in median home resale values, the rise in Walla Walla County has been steeper than other parts of eastern Washington and the state average.

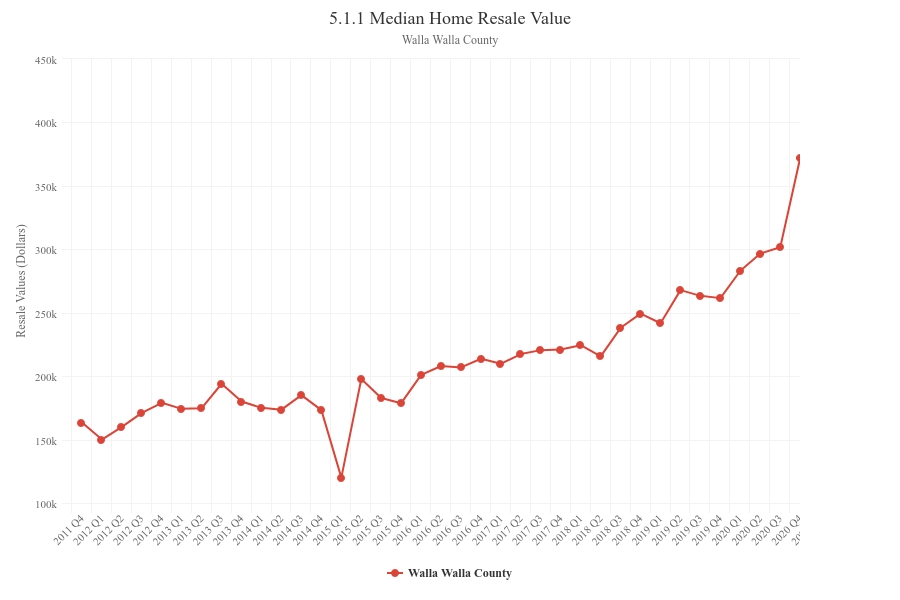

Walla Walla Trends 5.1.1 Median Home Resale Value presents the quarterly median resale value of homes in the county, benchmarked against the state. The data come from the Washington Center for Real Estate Research (WCRER) and provide estimates for the counties as well as the state average. This measure does not include the prices of newly constructed homes.

Beginning in early 2018, median home resale prices all around the state began a steeper ascent that continued through the pandemic. Across the state, the median home resale price increased by 26% between mid-2020 and the end of 2021. Over that same time period, Walla Walla saw an increase of 32%, or resale values increased from $300,000 to nearly $400,000 over the last six quarters!

The recent growth in home prices for the county has also outpaced other counties in eastern Washington. For the most part, the counties experienced increases below the state average. For example, in the last six quarters, Whitman County saw an uptick of only 16%, while prices in the counties of Benton, Franklin and Spokane grew 21%.

To be fair, housing prices have been rising pretty consistently in Walla Walla County over the past decade, especially in the past four years. Since fourth quarter of 2017, median home prices in the county have risen over 80% whereas the state average has only increased by 58%.

While the pandemic largely disrupted economic activity throughout communities, there was not a noticeable change in the trajectory of median home resale prices. In part, with as many people moved to working remotely, they chose to renovate existing homes, adding home offices and workspaces and making them less likely to sell. Additionally, slowed construction during the early parts of the pandemic further reduced supply, continuing to drive up prices of existing homes.

The reduction in the monthly supply of housing is tracked in Walla Walla Trends indicator 5.1.4 Monthly Supply of Homes Listed by Price Level. The month's supply of housing by price range calculates approximately how many months it would take for the current inventory of homes for sale in Walla Walla County to be exhausted. In just the past year alone, the total monthly supply of homes for sale has dropped to under two months, less than half the state average of five months. See the accompanying article for further details.

The sustained increase in median home resale value is currently outpacing the increase in incomes, putting downward pressure on the housing affordability index. The Housing Affordability Index (HAI) is tracked in Walla Walla Trends 5.1.2. Although the county is still more affordable than the state average, affordability has been falling, so that for the first time in the Trends’ tracking the indicator the index has fallen below 100. Because the HAI is the ratio of income to the cost of mortgage expenses on a median price home, a value below 100 implies that monthly mortgage payments are making up more than 25% of the monthly median household income. Although data on median household income is not yet available for 2020 & 2021, it is not likely that incomes have been able to keep pace with the increases in median home resale values. Decreasing affordability could create problems for the ability of the local economy to attract and retain workers.

Some good news has recently arrived from state measures. Increases in home resale values leveled off towards the end of 2021, perhaps even if for a short respite. It is possible that Walla Walla County could follow in this trend. Although prices are not likely to fall, future increases might not be as steep as they have been in the last several years.